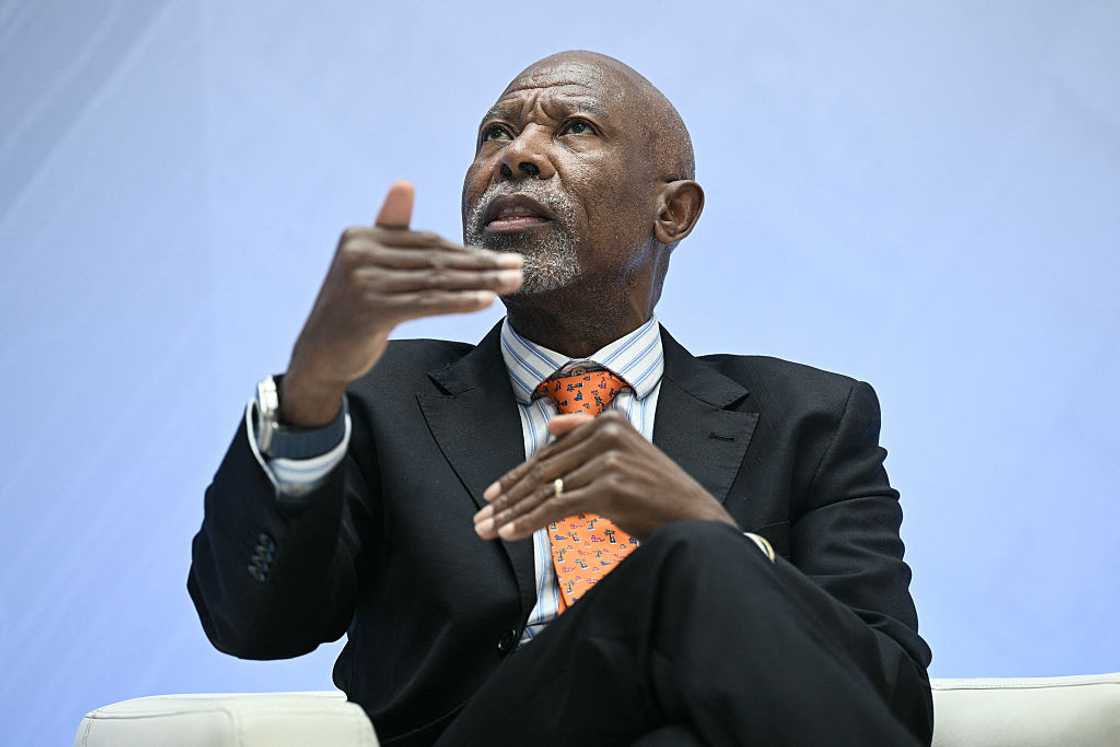

SA Reacts As SARB Governor Lesetja Kganyago Cuts Repo Rate by 25 Basis Point to 10.5 Percent

- The South African Reserve Bank's governor, Lesetja Kganyago, announced that the repo rate has been slashed

- He said that the interest rate has decreased by 7.5% which means that the lending rate dropped to 10.5%

- South Africans were not relieved as they feared that food and day-to-day expenses would continue to rise

PAY ATTENTION: You can now search for all your favourite news and topics on Briefly News.

Tebogo Mokwena, a current affairs journalist, contributed analysis of policy changes and the budget speech during his 7 years at Vutivi Business News and Daily Sun.

Source: Getty Images

PRETORIA — South Africans were not relieved when the South African Reserve Bank (SARB) governor Lesetja Kganyago slashed the repo rate by 25 basis points on 31 July 2025.

According to SABC News, Kganyago said that the Monetary Policy Committee cut the repo rate to 7% reducing the lending rate to 10.5%. The country's inflation data for June suggested that it was well under control in the country. At the previous meeting, the MPC cut the repo rate to 7.25% and the lending rate to 10.75%.

Muted economic growth, subdued price inflation, and the restriction of real rates made it possible for additional monetary support.

PAY ATTENTION: Briefly News is now on YouTube! Check out our interviews on Briefly TV Life now!

Source: Getty Images

What has been happening in the economy?

The Minister of Finance, Enoch Godongwana, delivered the 2025 Budget speech on 21 May after his first two attempts were rejected. Godongwana's preceding speeches aimed at increasing the Value Added Tax. Ne announced that the VAT would remain at 15% but added that there would be a fuel levy increase.

The Economic Freedom Fighters filed an urgent application with the Western Cape High Court to prevent the implementation of the fuel levy. However, the court dismissed the application with costs.

Consumer price inflation also increased. On 23 July, Statistics SA published its latest consumer price inflation data, which showed how food inflation increased. The consumer price inflation increased by 0.3% in June from 3% in May. Meat inflation increased by 6.6% from 2024 to 2025. Fish and other seafood increased by 4.

Read also

Brazilian woman nabbed at OR Tambo with R4.2 million worth of cocaine, SA believes it's just a decoy

What did South Africans say?

Netizens commenting on Facebook bemoaned the rising prices despite the slashing of the interest rate.

Mazibuko Lydia said:

"But the financial lenders and institutions still charge more. They don't automatically reduce debts or improve credit scores for borrowers."

Gcin'isizwe Dosini Tshitshi said:

"Let's blame Ramaphosa as usual."

Richard Jones said:

"10.5% is still too high. Income is not in line. South Africa can also start to produce instead of consume."

Thabo Mntungwa asked:

"Can we also have a cut on fuel prices, please?"

Sabelo Jongolo said:

"Perfect result. Good feedback, Kganyago, and if you continue with the good work, the Rand currency can become strong again."

Johannesburg woman compares groceries between 2010 and 2025

In a related article, Briefly News reported that a woman from Johannesburg compared groceries bought for R1000 in 2010 and 2025. She posted a video on TikTok of the comparison.

The video showed how R1000 15 years ago could afford various fruits and vegetables, meat, cereals, water, and margarine. She contrasted that with 2025, where she showed that the same amount barely covered the essentials.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

Source: Briefly News